6 Months to Safe Harbor

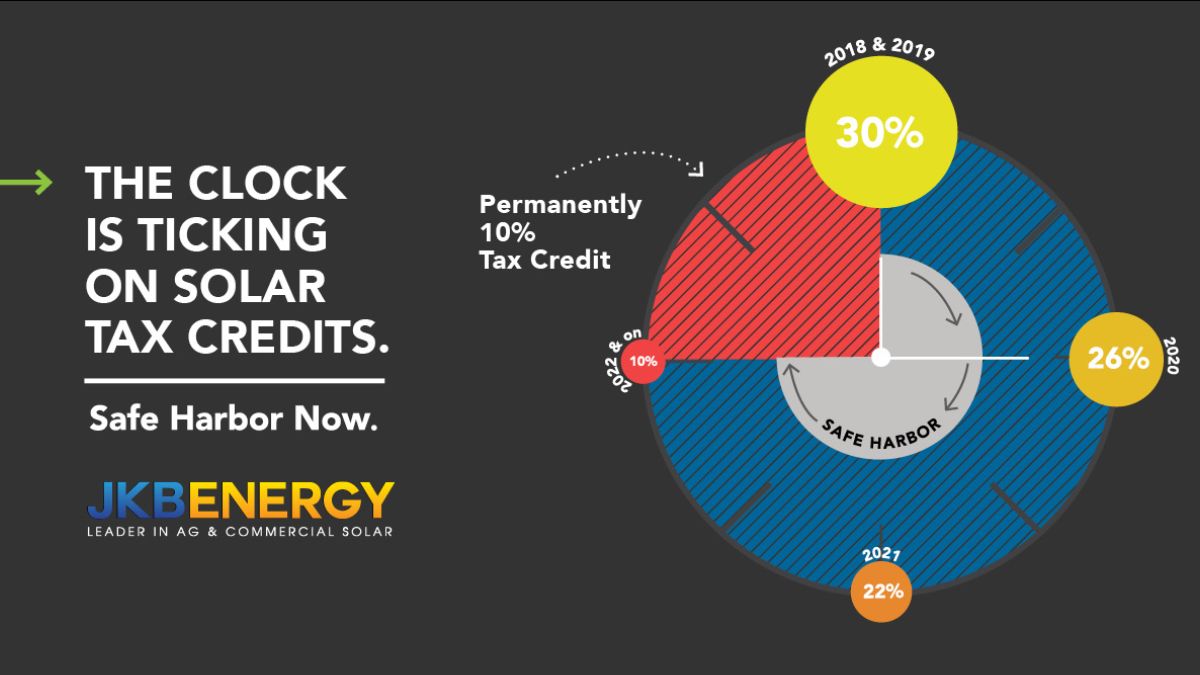

The clock is ticking on solar tax credits especially for growers and large businesses. Solar construction can take anywhere from 6 to 12 months depending on the size and scope of some projects. By committing now, you can take advantage of the Safe Harbor. If you have already paid 5 percent into a project before December 31, 2019 you can claim the full 30 percent credit, the year in which system is completed through 2023.

Solar customers have the option to take advantage of the last major tax credit in 2019, however these savings won’t be around much longer. The new tax reform and legislative terms include a 30% Federal Investment Tax Credit (ITC) that is valid only through 2019. After 2019 the credit will continue to drop down every year eventually reaching 10 percent in the year 2022, where it will remain indefinitely for businesses.

Why Invest?

Essentially, by installing a solar energy system this allows the customer to deduct 30 percent of the cost from their federal taxes. The ITC applies to both residential and commercial systems, with no cap on its value.

“In our experience, we’re seeing financial institutions aggressively seek out solar projects. With a variety of banking options, it’s a win-win for our customer and the financiers,” mentions Chad Cummings, Director of Sales and Marketing.

How to Invest:

-

Contact a JKB Energy sales team member

-

Our team will visit the property to locate the best installation locations

-

Our in-house engineers team will create system designs for your solar locations

-

Our team will present a proposal that fits your solar needs

-

Our team will review the safe harbor requirements and process paperwork to Safe Harbor your 30 percent tax credit.

For any additional information or questions call us at (209) 668-5303 or email info@jkbenergy.com.